Rahbord Energy: Isfahan Petrorefinery has tried to renovate itself by defining and implementing value chain projects in accordance with global standards. The Petrorefinery, under the management of Dr. Mohsen Ghairi, is now turning into the biggest Petrorefinery holding in the Mideast. It has upgraded the Isfahan Petrorefinery and turned it into a profitable business. It’s now trying to join the top 500 global firms and the top 10 world refineries. It has now raised its Nelson Complexity Index to 16 and delineated a prospect for the future. Isfahan Petrorefinery now enjoys a leading gap with other refineries and petrochemicals in the region. It has now developed and devised its shares with the aim of profitability, sustainable development, and an environment-friendly industry.

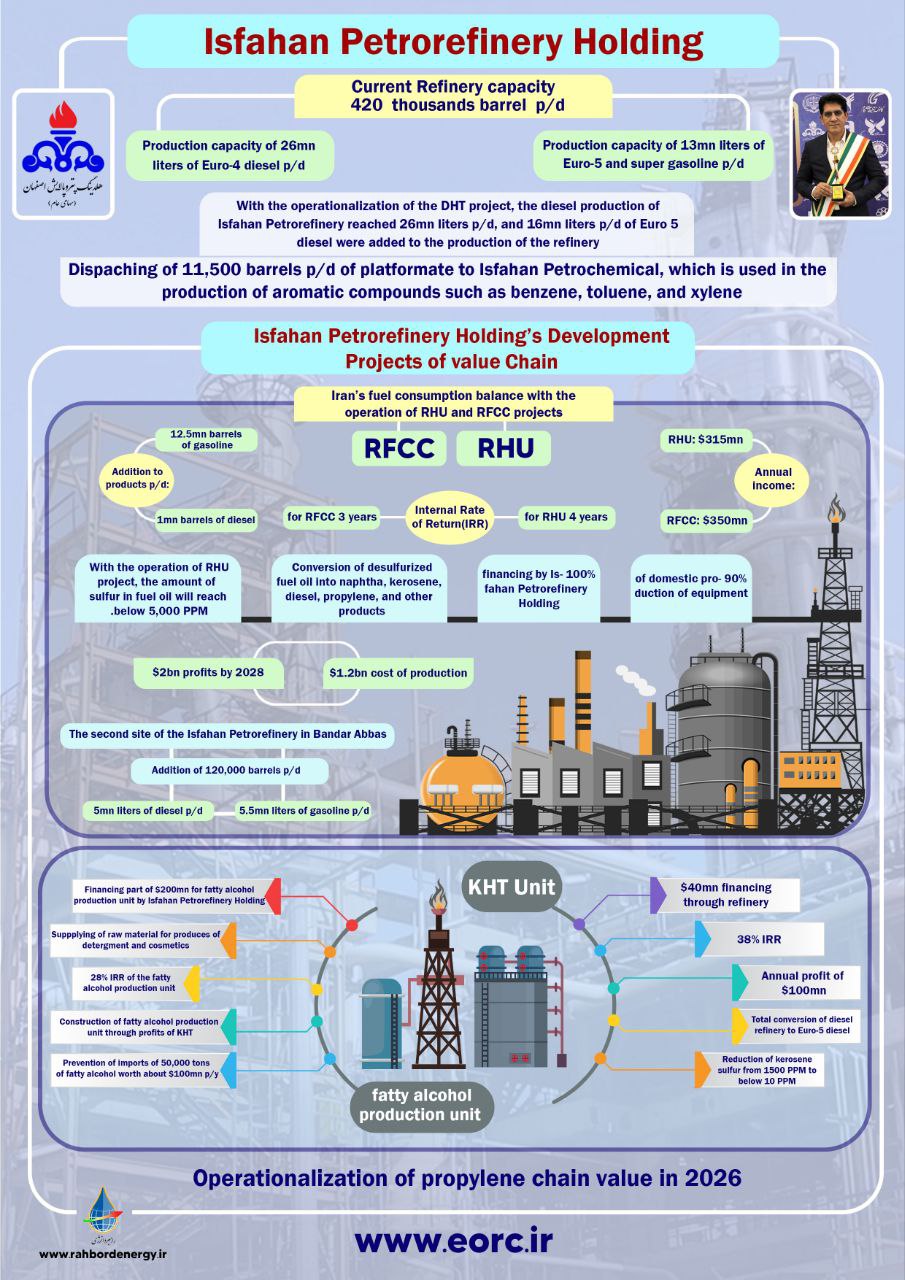

The current refining capacity of Isfahan Petrorefinery is 420,000 barrels per day, which includes the production capacity of 13 million liters per day of Euro 5 and super gasoline and 26 million liters per day of Euro 4 diesel. It is worth mentioning that with the operationalization of the DHT project, the diesel production of Isfahan Petrorefinery reached 26 million liters per day, and 16 million liters per day of Euro 5 diesel were added to the production of the refinery. Furthermore, currently, 11,500 barrels per day of platformit are sent to Isfahan Petrochemical, which is used in the production of aromatic compounds such as benzene, toluene, and xylene. The volume received by Isfahan Petrochemical will increase in line with development plans.

Iran’s fuel consumption balance with the operation of the RHU and RFCC projects of Isfahan Petrorefinery

The projects RHU (desulfurization of the bottom of the distillation tower) and RFCC (fluid bed catalytic cracking process unit) are the most important of these projects.

With the operation and production of RHU and RFCC, a total of about 12.5 million liters of gasoline and about 1 million liters of diesel will be added to Isfahan Petrorefinery, which will help to balance the country’s fuel consumption by 2026–2027.

The second site of the Isfahan Refinery in Bandar Abbas, with a capacity of 120,000 barrels per day, will add 5.5 million liters of gasoline and 5 million liters of diesel to the fuel capacity of Iran.

The fuel oil currently produced by Isfahan Petrorefinery has about 30,000 PPM of sulfur, and with the launch of the first RHU project, the amount of sulfur in fuel oil will reach below 5,000 PPM in March 2025.

The RFCC unit converts desulfurized fuel oil into valuable light products such as naphtha, kerosene, diesel, propylene, and other products.

The RHU and RFCC refining projects cost a total of about $1.2 billion, and the internal rate of return for RHU is 4 years and for RFCC is about 3.8 years. 100% of that will be financed by Isfahan Petrorefinery Holding.

Also, about 90% of the equipment for the projects being implemented at Isfahan Petrorefinery is domestically made.

Isfahan Petrorefinery will earn $315 million and $350 million per year by operating the RHU and RFCC units, respectively.

The LPG unit of Isfahan Petrorefinery currently produces about 18 thousand barrels per day, equivalent to about 1000 tons per day of LPG, which are sent to the tanks of the National Iranian Oil Products Distribution Company (NIOPDC). Isfahan Petrorefinery will be put into service in 2026–2027 as part of the LPG value chain, which is the production of polypropylene. By 2027-2028, about $2 billion per year will be added to the income of the holding with the launch of petrochemical units at Isfahan Petrorefinery.

Annual income of $100 million, the development of the value chain with the inauguration of the KHT Petrorefinery of Isfahan project, and the production of fatty alcohols

The KHT (kerosene desulfurization) project is one of the other value chain projects that will reduce the current kerosene sulfur from PPM 1500 to below PPM 10 by completely converting the refinery diesel to Euro 5 diesel.

The required capital for the KHT unit is $40 million, which will be financed through the refinery. The production unit of fatty alcohols requires $200 million, part of which is financed by Isfahan Petrorefining Holding. The Fatty Alcohol Production Unit will be financed through the profits made from the KHT Unit. The internal rate of return of the KHT unit is approximately 38%, and that of the fatty alcohol unit is 28%. By operating the fatty alcohol production unit, the annual import of more than 50 thousand tons of fatty alcohol worth about $100 million will be obviated. It is used as a raw material for the production units of detergents and health and cosmetic products.

With the intelligent and efficient management of Dr. Ghadiri, Isfahan Petrorefinery Holding has guaranteed the long-term benefits and profitability of the company and its shareholders. It has now defined the unique advantages of this company with a comprehensive development strategy and is moving towards a knowledge-based economy.